Finding Car Insurance Providers in Santaquin

Car insurance santaquin – Finding the right car insurance in Santaquin, Utah, involves understanding the available options and comparing providers to find the best fit for your needs and budget. Several major companies and local agents serve the Santaquin area, offering a range of coverage options and price points. Careful research and comparison shopping are crucial to securing the most suitable policy.

Okay, so like, finding cheap car insurance in Santaquin is, like, a total vibe kill. But, you know, managing all those customers is a whole other ball game; you need something totally on point, like checking out best crm software for hotels to keep things organized. Then, after you’re all set with that, you can totally chill and focus on finding the best car insurance rates in Santaquin again.

Major Car Insurance Companies in Santaquin

Many large national car insurance companies operate in Santaquin, offering a wide variety of coverage options. These companies often have extensive online resources and customer service networks. Choosing a large provider can offer convenience and a sense of security due to their established presence. However, it’s important to compare their offerings with those of smaller, potentially more localized providers.

Comparison of Car Insurance Providers in Santaquin

The following table compares features and pricing for three hypothetical car insurance providers in Santaquin. Remember that actual prices will vary based on individual factors such as driving history, vehicle type, and coverage choices. This table provides a general comparison for illustrative purposes.

| Provider | Average Annual Premium (Estimate) | Key Features | Customer Service Rating (Hypothetical) |

|---|---|---|---|

| Provider A (Example: Geico) | $1200 | 24/7 online access, accident forgiveness, roadside assistance | 4.5 stars |

| Provider B (Example: State Farm) | $1350 | Bundling discounts, strong local agent network, various coverage options | 4.2 stars |

| Provider C (Example: Progressive) | $1100 | Name Your Price® Tool, strong online presence, customizable coverage | 4 stars |

Local Independent Insurance Agents in Santaquin

Independent insurance agents in Santaquin offer a valuable service by representing multiple insurance companies. This allows them to compare policies from various providers, helping you find the best coverage at the most competitive price tailored to your specific needs. Working with a local agent often provides personalized service and a strong community connection. They can guide you through the process, answer your questions, and assist with claims.

Obtaining a Car Insurance Quote in Santaquin: A Flowchart

The process of obtaining a car insurance quote in Santaquin generally follows these steps. This flowchart visually represents the process.[Descriptive Flowchart]The flowchart would begin with a “Start” box. The next box would be “Gather necessary information (driver’s license, vehicle information, etc.).” This would flow into “Choose method: Online, phone, or in-person agent.” Each of these choices would lead to a separate path.

The online path would involve “Fill out online application.” The phone path would involve “Contact provider by phone.” The in-person agent path would involve “Visit a local agent’s office.” All three paths would converge at “Receive quote.” From there, the flowchart would branch into “Accept quote and purchase policy” or “Compare quotes from multiple providers.” The final box would be “End.”

Factors Affecting Santaquin Car Insurance Costs: Car Insurance Santaquin

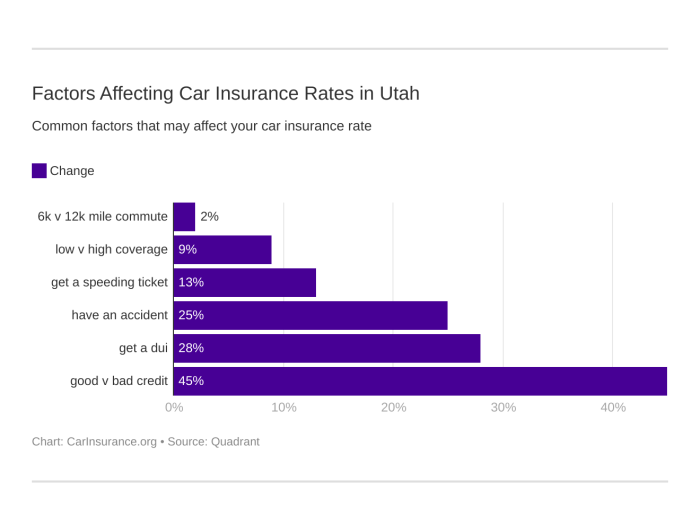

Several key factors influence the cost of car insurance in Santaquin, Utah, impacting the premiums individuals and families pay. Understanding these factors allows for better informed decisions when selecting a policy. These factors interact in complex ways, and the overall cost is a result of their combined effect.

Driving History’s Impact on Premiums, Car insurance santaquin

A driver’s history significantly impacts Santaquin car insurance rates. Insurance companies assess risk based on past driving behavior. A clean driving record, free of accidents and traffic violations, generally results in lower premiums. Conversely, accidents, speeding tickets, DUIs, or other moving violations increase premiums, reflecting the higher perceived risk. The severity and frequency of incidents further amplify the impact.

For example, a single minor accident might increase premiums moderately, while multiple serious accidents or a DUI conviction could lead to substantially higher costs or even policy cancellation. Insurance companies use statistical models to analyze driving records and assign risk scores, which directly translate to premium calculations.

Credit Scores and Car Insurance Rates

In many states, including Utah, credit scores play a role in determining car insurance rates. While the exact correlation varies by insurer, a higher credit score generally correlates with lower premiums. Insurers use credit scores as an indicator of overall financial responsibility. The reasoning is that individuals with good credit management are statistically less likely to file fraudulent claims or have difficulty paying premiums.

Conversely, a poor credit score may signal a higher risk to the insurance company, leading to higher premiums. It’s important to note that this practice is subject to state regulations and not all insurers use credit scores equally.

Available Car Insurance Discounts

Many car insurance providers in Santaquin offer various discounts to reduce premiums. These discounts incentivize safe driving practices and responsible vehicle ownership. Common discounts include those for good student records (high GPA), safe driver courses completion, multiple vehicle insurance (insuring more than one car with the same company), bundling home and auto insurance, anti-theft devices installation, and choosing higher deductibles.

The specific discounts available and their amounts vary depending on the insurer and the individual’s circumstances. For example, a student with a high GPA might receive a significant discount, while someone with an anti-theft system installed in their car might receive a smaller but still valuable reduction in their premium.

Cost Comparison Across Vehicle Types

The type of vehicle insured significantly impacts the cost of car insurance in Santaquin. Generally, larger and more expensive vehicles, such as SUVs and trucks, tend to have higher insurance premiums compared to smaller, less expensive sedans. This is because these larger vehicles often cost more to repair or replace in case of an accident, and statistically, they may also be involved in more severe accidents.

Factors like the vehicle’s safety rating, theft risk, and repair costs also influence the premium. For example, a luxury SUV will typically have higher insurance costs than a comparable-sized sedan due to its higher repair costs and potential for greater damage in an accident. Conversely, a fuel-efficient compact car may have lower insurance costs due to its lower repair costs and potentially lower risk profile.

Illustrative Scenarios of Car Insurance in Santaquin

Understanding real-life scenarios helps clarify how car insurance works in Santaquin. These examples illustrate the claims process and the impact of life changes on coverage needs.

Minor Car Accident Claim Process

Imagine a Santaquin resident, Sarah, is involved in a minor fender bender. Her car sustains damage to the bumper, and the other driver’s car has a small scratch. Sarah immediately calls the police to file a report, documenting the accident details, including the location, time, and witness information. She then contacts her insurance company. The insurer will initiate an investigation, potentially requesting photos of the damage, police reports, and statements from involved parties.

If liability is determined, Sarah’s insurance will cover the repairs to her car, potentially minus any deductible she has. The other driver’s insurance might be responsible for Sarah’s deductible and any other costs. The process might involve appraisals, negotiations with repair shops, and the eventual settlement of claims. The timeline for resolution varies depending on the complexity of the case and the cooperation of all involved parties.

Adjusting Coverage Due to Life Changes

Consider John, a Santaquin resident who recently got a new job requiring a longer commute. He also purchased a newer, more expensive car. These changes significantly impact his car insurance needs. His increased commute increases his risk of accidents, justifying higher liability coverage. The value of his new car necessitates increased collision and comprehensive coverage to adequately protect his investment.

John needs to contact his insurance provider to adjust his policy. He will likely see a rise in his premiums to reflect the increased risk and coverage amounts. He may explore different coverage options to find the best balance between cost and protection, potentially opting for higher deductibles to lower premiums. Conversely, if John were to get a job closer to home and sell his new car for an older, less expensive model, he might be able to reduce his coverage and premiums accordingly.

Impact of Different Coverage Levels on Cost

The following table illustrates how different coverage levels affect the cost of car insurance in Santaquin. Note that these are illustrative figures and actual costs vary based on individual factors.[Descriptive text representing a chart]Imagine a chart with “Coverage Level” on the horizontal axis and “Annual Premium” on the vertical axis. Three bars represent different coverage levels: “Minimum Coverage” (shortest bar, lowest cost), “Standard Coverage” (medium bar, medium cost), and “Comprehensive Coverage” (longest bar, highest cost).

The chart visually demonstrates that increasing coverage levels generally lead to higher annual premiums. The difference in cost between minimum and comprehensive coverage is significant, highlighting the trade-off between cost and protection. For example, minimum coverage might cost $500 annually, standard coverage $800, and comprehensive coverage $1200. These are illustrative figures and actual costs vary based on individual factors such as driving record, age, and vehicle type.