Introduction to Car Insurance Hidden Fees

Hidden fees and charges in car insurance explained – The feeling of relief after securing a seemingly great car insurance deal can quickly turn to frustration when unexpected fees pop up. These “hidden” fees, often buried deep within the fine print, can significantly inflate your final cost, leaving you feeling betrayed and financially strained. Understanding these hidden costs before committing to a policy is crucial to avoid this unpleasant surprise and ensure you’re making an informed decision about your financial well-being.

Ignoring them could mean paying hundreds, even thousands, more than you initially anticipated.Understanding these fees before you buy a policy is paramount. Think of it like this: you wouldn’t buy a house without knowing the property taxes, right? Similarly, you shouldn’t commit to car insurance without a complete understanding of all associated costs. Knowing what to expect empowers you to compare policies accurately and choose the one that truly fits your budget.

This proactive approach protects you from financial shocks and allows you to budget effectively.

Examples of Common Hidden Fees

Several common situations can lead to unexpected charges on your car insurance bill. These often arise from seemingly minor details that can have a major impact on your overall cost. For example, a seemingly insignificant detail, such as an overlooked driving infraction or an inaccurate assessment of your vehicle’s value, can dramatically increase your premium. These seemingly small oversights can lead to significant financial burdens.

Types of Hidden Fees and Charges

Navigating the world of car insurance can feel like traversing a minefield, especially when unexpected fees pop up. These hidden costs, often buried deep within the fine print, can significantly inflate your premiums and leave you feeling frustrated and betrayed. Understanding these charges is crucial to making informed decisions and avoiding unpleasant surprises. Let’s shed light on some of the most common culprits.

Many seemingly straightforward car insurance policies harbor a collection of less-than-transparent fees. These charges, often presented as administrative necessities, can add hundreds, even thousands, of dollars to your overall cost over the policy’s lifespan. The lack of upfront disclosure often leaves consumers feeling misled and vulnerable. The structure and calculation of these fees vary widely between providers, highlighting the importance of careful comparison shopping.

Administrative Fees

Administrative fees are often levied for tasks related to processing your application, making changes to your policy, or handling claims. These fees can range from a modest sum to a surprisingly hefty amount, depending on the insurer and the specific service. For example, some companies might charge a fee for simply updating your address, while others might add a substantial charge for processing a claim, even if the claim is legitimate and within the policy’s coverage.

The calculation of these fees is rarely transparent; the insurer may cite “administrative overhead” as justification, offering little concrete explanation of what constitutes the cost.

Processing Fees, Hidden fees and charges in car insurance explained

Similar to administrative fees, processing fees are often associated with specific actions related to your policy. These fees can arise when you submit a claim, make a payment, or even request a copy of your policy documents. The fee amounts vary significantly between insurance providers, and the criteria for applying these fees can be vaguely defined. One insurer might charge a flat fee per claim, while another might base the fee on the claim’s complexity or the amount of paperwork involved.

The lack of clear guidelines regarding these fees leaves consumers susceptible to unexpected charges.

Cancellation Fees

Cancellation fees are a significant concern for policyholders. These fees, charged when you decide to cancel your policy before its expiration, can be substantial and vary greatly depending on the insurer and the reason for cancellation. Some insurers may charge a percentage of your remaining premium, while others might impose a fixed fee. The calculation often lacks transparency, with some insurers citing contractual obligations or administrative costs as justification.

It’s vital to carefully review the cancellation policy before signing up for any insurance plan to avoid unexpected financial burdens.

Comparison of Fee Structures

A direct comparison of fee structures across different insurance providers reveals a stark contrast in transparency and fairness. Some companies openly list all fees on their websites, providing detailed explanations of how these charges are calculated. Others bury these fees within lengthy policy documents, making it difficult for consumers to identify and compare them. This lack of transparency makes it challenging to identify the most cost-effective option, forcing consumers to spend significant time deciphering policy documents.

The variations in fee structures emphasize the need for careful scrutiny and comparison shopping before committing to an insurance provider.

Factors Influencing Hidden Fees

The frustrating truth about car insurance is that the advertised price is rarely the final price. Many hidden fees can significantly inflate your premiums, leaving you feeling cheated and bewildered. Understanding the factors that influence these hidden costs is crucial to protecting your wallet and ensuring you get the best possible deal. These factors are interconnected and can dramatically impact your overall insurance expenses.

Several key elements determine the presence and magnitude of these often-overlooked charges. Your personal characteristics, the vehicle you drive, the level of coverage you choose, and even your geographical location all play a significant role in shaping your final bill. Let’s delve into these influencing factors.

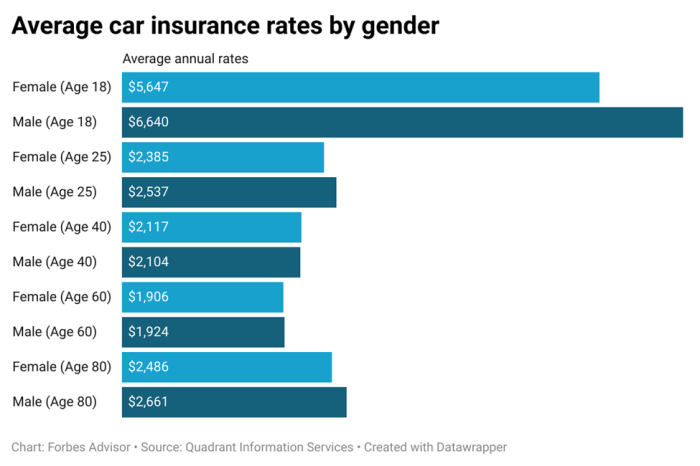

Driver Profile’s Influence on Hidden Fees

Your driving history, age, and credit score are significant factors determining the hidden fees you might encounter. A young driver with a less-than-perfect driving record will likely face higher fees than a seasoned driver with a clean record. Similarly, a poor credit score can trigger higher premiums, often masked within seemingly standard rates. Insurance companies use these factors to assess risk, and a higher perceived risk often translates into additional, less-transparent charges.

For example, a surcharge for young drivers might be presented as a standard rate increase, but it’s effectively a hidden fee because it’s not always clearly explained upfront.

Vehicle Type and Hidden Fees

The type of vehicle you insure also impacts hidden fees. Luxury cars, high-performance vehicles, and vehicles with a history of theft or accidents tend to attract higher premiums and more hidden fees. These fees can be disguised within administrative charges or other seemingly minor add-ons. For instance, a higher rate for anti-theft device installation might be considered a standard part of the premium, but in reality, it functions as a hidden fee.

The cost of repairing or replacing a high-value vehicle is naturally higher, thus influencing the overall premium and the potential for additional, less-transparent charges.

Coverage Level and Associated Hidden Fees

The level of coverage you select significantly impacts the presence and amount of hidden fees. While comprehensive coverage offers extensive protection, it often comes with a higher price tag and more opportunities for hidden fees to creep in. Optional add-ons, such as roadside assistance or rental car reimbursement, are frequently presented as separate costs, even though they might be considered integral parts of a comprehensive policy by many consumers.

A seemingly small add-on can inflate the overall cost considerably, effectively acting as a hidden fee.

Geographical Location and Hidden Fees

Your location plays a crucial role in determining your car insurance costs and the potential for hidden fees. Areas with high accident rates, theft rates, or natural disaster risks will generally have higher premiums. These higher premiums often include hidden fees embedded within the overall cost, making it difficult to discern the actual cost breakdown. For example, a higher rate for flood coverage in a coastal area is a form of hidden fee, because it’s not explicitly detailed as an additional cost but rather is factored into the standard rate.

Comparison of Hidden Fees Across Different Insurance Types

The following table illustrates how hidden fees can vary depending on the type of insurance coverage.

| Insurance Type | Common Hidden Fees | Potential Impact on Premium | Example |

|---|---|---|---|

| Liability | Administrative fees, policy processing fees | Slight increase | A $25 administrative fee added to the base premium. |

| Collision | Deductible waivers, rental car reimbursement fees | Moderate increase | A $100 monthly fee for rental car reimbursement. |

| Comprehensive | Roadside assistance fees, additional coverage for specific events (e.g., hail damage in areas prone to hailstorms) | Significant increase | A bundled roadside assistance package costing $50 annually. |

Reading and Understanding Your Policy Document

The fine print in your car insurance policy can feel like navigating a dense jungle, but understanding it is crucial to avoid unexpected costs. Many hidden fees lurk within the seemingly impenetrable language of these documents, waiting to ambush you at the most inconvenient time. Don’t let this happen; take control and become your own insurance detective. Arming yourself with knowledge is the best defense against these hidden charges.This section provides a step-by-step guide to help you decipher your policy and unearth those sneaky hidden fees.

We’ll explore common policy wording used to mask these extra costs and provide a handy checklist to help you stay vigilant. Remember, understanding your policy is your right, and it’s the key to ensuring you’re paying only for the coverage you need and agreed upon.

Locating Hidden Fees Within Your Policy Document

Finding hidden fees requires a systematic approach. First, obtain a digital or printed copy of your policy document. Read the policy thoroughly, paying close attention to sections detailing exclusions, limitations, and additional charges. These are prime locations for hidden fees. Look for words like “deductible,” “co-pay,” “excess,” and “surcharges.” These terms often precede or are associated with additional costs that might not be immediately apparent.

Next, examine the declarations page, which summarizes your coverage and premiums. Verify that the premium quoted matches the coverage details Artikeld. Any discrepancies might signal a hidden fee or inaccurate pricing. Finally, don’t hesitate to contact your insurer directly if you find ambiguous or unclear wording. They are obligated to explain your policy clearly.

Remember, a persistent and informed consumer is the best protection against hidden fees.

Common Policy Wording Describing Hidden Fees and Their Implications

Insurance companies often use subtle language to obscure hidden fees. For example, phrases like “administrative fees,” “processing fees,” or “assessment fees” might seem innocuous but often represent extra charges. Similarly, clauses referring to “non-standard vehicles,” “high-risk drivers,” or “specific geographic locations” can lead to unexpectedly higher premiums. “Deductibles” are often clearly stated but understanding what constitutes a claim and what isn’t, is crucial.

A seemingly minor incident might push you into a higher deductible bracket than you anticipated. Understanding these terms and their implications is vital to avoid unpleasant surprises. If you encounter unclear or potentially ambiguous wording, always seek clarification from your insurer.

Checklist for Identifying Potential Hidden Fees

Before signing your policy, use this checklist to proactively identify potential hidden fees:

This checklist is designed to be used as a guide, not a legal document. Always consult your insurance policy for specific details.

- Review the declarations page: Does the premium match the coverage Artikeld?

- Scrutinize the exclusions section: What is specifically NOT covered? Are there any unexpected limitations?

- Examine the definitions section: Understand the precise meaning of key terms like “accident,” “damage,” and “loss.”

- Check for additional charges: Are there any fees for administrative tasks, processing, or assessments?

- Verify coverage limits: Are the limits sufficient for your needs? Are there any penalties for exceeding these limits?

- Investigate any surcharges: Are there any surcharges based on your driving record, location, or vehicle type?

- Confirm the deductible: Is the deductible clearly stated and understood?

- Understand the claims process: What are the steps involved in filing a claim? Are there any associated fees?

Negotiating and Avoiding Hidden Fees

The frustration of discovering unexpected charges on your car insurance bill is a feeling many drivers share. It’s a sneaky blow to your budget, leaving you feeling cheated and powerless. But you don’t have to be a victim. Armed with the right knowledge and strategies, you can actively negotiate lower fees or even avoid them altogether, reclaiming control over your insurance costs.

This section will equip you with the tools to navigate the often-murky waters of car insurance pricing and secure a fairer deal.Effective strategies exist to minimize or eliminate hidden fees. The key is proactive engagement and informed decision-making. Don’t passively accept the first quote you receive; instead, treat the process like a negotiation, aiming for transparency and a fair price.

Remember, you’re a consumer, and you have rights.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is paramount. This simple yet powerful action allows you to see the vast differences in pricing and coverage that can exist between companies. Don’t just focus on the initial premium; delve deeper into the details of each policy to uncover potential hidden costs. By comparing apples to apples, you can identify insurers who are transparent about their pricing and those who might be hiding extra fees.

For example, one company might advertise a low initial premium but then tack on significant administrative fees, while another might have a slightly higher initial premium but be upfront about all charges. This comparison empowers you to choose the insurer that best suits your needs and budget without the unpleasant surprise of hidden fees.

Asking Insurance Providers Key Questions

Before committing to a policy, it’s crucial to ask pointed questions directly to the insurance provider. This proactive approach eliminates ambiguity and ensures you understand all associated costs upfront. This transparency fosters trust and prevents future disputes.

Here are some essential questions to ask:

- What are all the fees associated with this policy, including any administrative, processing, or cancellation fees?

- Are there any additional charges for specific coverage options or add-ons?

- Does the premium include all applicable taxes and surcharges?

- What are the terms and conditions for discounts, and are there any hidden restrictions?

- What is the process for appealing or disputing any charges?

- Can you provide a detailed breakdown of the premium calculation, showing how each component contributes to the total cost?

Negotiating Lower Fees

Once you have a clear understanding of the fees involved, you can begin the negotiation process. Don’t be afraid to politely challenge any fees that seem excessive or unjustified. Highlight your comparison of quotes from other insurers, emphasizing their more competitive pricing. Many insurers are willing to negotiate, particularly if you’re a loyal customer or if you’re prepared to switch providers.

Remember to document all communications and agreements in writing. For instance, if you successfully negotiate a lower administrative fee, obtain written confirmation of the revised amount. This protects you from future discrepancies.

Dispute Resolution for Unfair Hidden Fees

Discovering a hidden fee on your car insurance bill can feel like a punch to the gut. That feeling of betrayal, of being misled, is entirely understandable. But don’t despair; you have options. Understanding the dispute resolution process can empower you to fight back and potentially reclaim your unfairly spent money. This section Artikels the steps you can take to challenge these unexpected charges and seek a fair resolution.The process of disputing unfair or unexpected hidden fees typically begins with directly contacting your insurance company.

Clearly and calmly explain the issue, referencing specific clauses in your policy that you believe contradict the charge. Keep detailed records of all communication, including dates, times, and the names of the individuals you speak with. Many companies have internal dispute resolution departments designed to handle such complaints. If your initial attempts are unsuccessful, you’ll need to escalate the matter.

Filing a Complaint with Regulatory Bodies

If your insurer fails to resolve the issue satisfactorily, your next step involves filing a formal complaint with your state’s Department of Insurance or a similar regulatory body. These agencies are responsible for overseeing the insurance industry and ensuring fair practices. Their websites typically provide detailed instructions on how to file a complaint, often including online forms. Be sure to include all relevant documentation, such as your policy, the disputed bill, and records of your previous communication with the insurer.

These agencies have the power to investigate your complaint, mediate the dispute, and potentially impose penalties on the insurer if they find wrongdoing.

Examples of Successful Dispute Resolutions

While specifics vary by case and jurisdiction, successful dispute resolutions often involve the insurance company reversing the unfair charge or offering a partial refund. For example, one consumer successfully challenged a “processing fee” that was not clearly disclosed in their policy, resulting in a full refund of the disputed amount. In another case, an individual successfully argued that an additional charge for roadside assistance was not applicable due to pre-existing coverage.

The insurer, after an investigation, conceded and removed the charge. These examples illustrate the importance of meticulously reviewing your policy and maintaining detailed records of your communication with the insurer. Persistence and a clear understanding of your rights are key to achieving a successful outcome.

Illustrative Examples of Hidden Fees: Hidden Fees And Charges In Car Insurance Explained

Let’s face it: the advertised price of car insurance is rarely the final price. Hidden fees, like sneaky little gremlins, can creep into your policy, significantly impacting your budget. These examples illustrate how seemingly small charges can add up to a substantial increase in your overall cost, leaving you feeling frustrated and financially burdened.The following scenarios showcase how common hidden fees can inflate your car insurance premium, transforming a seemingly affordable policy into a considerable financial strain.

Understanding these examples is crucial for protecting your wallet and ensuring you’re paying only for the coverage you need and expect.

Administrative Fees

Imagine this: You’ve diligently paid your premiums on time for years. Then, you need to make a change to your policy – perhaps you’ve moved or added a driver. Suddenly, you’re hit with a seemingly arbitrary “administrative fee” for processing this simple request. This fee, often ranging from $25 to $50, can feel particularly unfair, especially when you’ve been a loyal customer.

The impact on your budget might seem small initially, but these fees can accumulate over time, especially if you frequently need to adjust your policy. For instance, if you move every two years and pay a $30 administrative fee each time, that’s an extra $150 over a five-year period – a significant addition to your insurance costs.

Reinstatement Fees

Let’s say you let your insurance lapse due to unforeseen circumstances. When you decide to reinstate your coverage, you might face a hefty reinstatement fee. This fee, often a percentage of your annual premium, can be substantial. Consider a scenario where your annual premium is $1200, and the reinstatement fee is 25%. That’s an additional $300 on top of your regular premium, a significant financial burden that could have been avoided with diligent payment.

This unexpected expense can severely strain a budget, especially during a period of financial difficulty that might have caused the lapse in coverage in the first place.

Emergency Roadside Assistance Upcharges

Many insurance companies offer roadside assistance as an add-on, but the price isn’t always clearly advertised. You might find that what you thought was included in your base premium is actually an extra monthly or annual charge. Let’s say the advertised premium is $100 per month, but the roadside assistance adds another $15. Over a year, that’s an extra $180, a significant increase that can be easily overlooked if the pricing isn’t transparent.

This hidden cost, while seemingly small on a monthly basis, adds up considerably over the life of your policy.

Comparison of Advertised vs. Actual Cost

To illustrate the impact of these hidden fees, let’s consider a visual representation. Imagine a simple bar graph. One bar represents the advertised premium of $1000 per year. The second, much longer bar, represents the actual cost, including all the hidden fees discussed – administrative fees, reinstatement fees (if applicable), and the upcharge for roadside assistance. This second bar might extend to $1300 or even $1400, vividly demonstrating how these seemingly small charges can dramatically inflate the final cost.

The difference between the two bars represents the hidden fees, visually showcasing the significant financial burden these fees place on the policyholder. This clear visual representation makes the hidden costs far more impactful and understandable.