Finding and Comparing Car Insurance Quotes: Shop For Car Insurance In Texas

Shop for car insurance in texas – Finding the right car insurance in Texas can feel overwhelming, but with a systematic approach, you can easily compare quotes and find the best coverage for your needs. This section will guide you through the process of obtaining and comparing quotes, highlighting key factors that influence your premium and providing a structured approach to decision-making.

Obtaining Car Insurance Quotes Online

Many Texas car insurance providers offer online quote tools for quick and convenient comparisons. Simply visit the insurer’s website, and you’ll typically find a quote request form. You’ll need to provide basic information such as your address, driving history, vehicle details, and desired coverage levels. Several comparison websites also aggregate quotes from multiple insurers, allowing you to see a wider range of options in one place.

These websites typically use algorithms to match you with the best potential insurers based on your input, saving you the time of visiting numerous individual websites.

Factors Influencing Car Insurance Premiums in Texas

Several factors significantly impact your car insurance premiums in Texas. Your age plays a role, with younger drivers often paying more due to higher accident risk. Your driving record is crucial; accidents, tickets, and DUI convictions will increase your premiums. The type of vehicle you drive influences your rates; expensive or high-performance cars generally cost more to insure. Your location matters; areas with higher accident rates tend to have higher premiums.

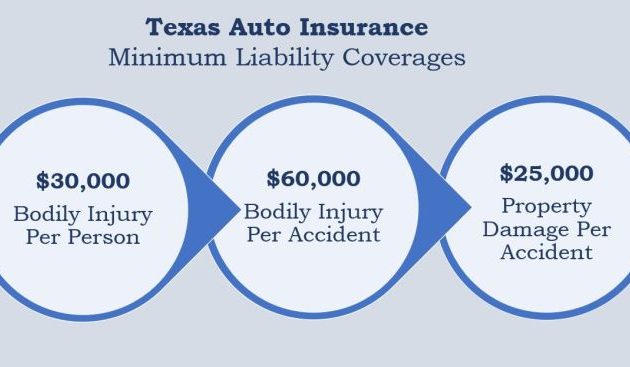

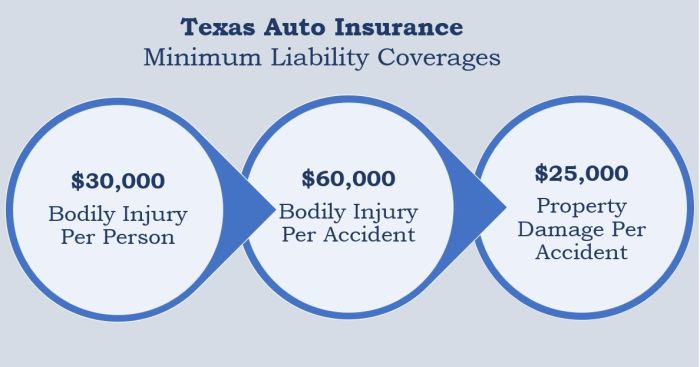

Other factors include your credit score, the coverage levels you choose (liability, collision, comprehensive), and whether you opt for additional features like roadside assistance. For example, a young driver with a history of speeding tickets driving a sports car in a high-crime urban area will likely pay significantly more than an older driver with a clean record driving a sedan in a rural area.

Comparing Car Insurance Quotes

To effectively compare quotes, follow these steps:

- Gather quotes from at least three different insurance providers. This ensures you have a broad range of options to compare.

- Use a consistent set of criteria for each quote. Ensure you’re comparing the same coverage levels (liability limits, deductibles, etc.) across all quotes to make a fair comparison.

- Analyze the total annual cost of each policy. Don’t just focus on the monthly payment; consider the total yearly cost to get a complete picture.

- Review the policy details carefully. Understand the specific coverage each policy provides, including exclusions and limitations.

- Compare customer service ratings and reviews. A reputable insurer with excellent customer service can be invaluable if you need to file a claim.

Key Questions to Ask Insurance Providers, Shop for car insurance in texas

Before committing to a policy, it’s essential to ask specific questions to clarify any uncertainties. These questions ensure you fully understand the terms and conditions of the insurance policy you are considering.

- What are the specific coverages included in your policy?

- What are the deductibles and premiums for each coverage type?

- What is your claims process, and how long does it typically take to resolve a claim?

- What discounts are available to me?

- What are your customer service hours and contact methods?

Types of Car Insurance Providers in Texas

Choosing the right car insurance provider is a crucial decision, impacting both your financial protection and peace of mind. Understanding the different types of providers available in Texas is the first step towards making an informed choice. This section will explore the key differences between large national companies, regional insurers, and independent agents, highlighting their respective advantages and disadvantages.

The Texas car insurance market offers a diverse range of providers, each with its own approach to customer service, policy offerings, and pricing. Choosing wisely depends on your individual needs and preferences. By understanding the strengths and weaknesses of each type of provider, you can select the one best suited to your situation.

Large National Car Insurance Companies

Large national companies, such as State Farm, Geico, and Progressive, offer widespread availability, extensive advertising, and often standardized policies across the country. These companies typically boast substantial financial resources, ensuring claims are paid promptly. However, their size can sometimes translate to less personalized service and potentially higher premiums due to broader risk pools. They often rely on streamlined processes and may have less flexibility in negotiating policy terms.

Regional Insurers

Regional insurers focus their operations within a specific geographic area, often providing more localized service and potentially deeper understanding of regional risks. This localized focus can lead to more competitive pricing in their target markets and a stronger sense of community involvement. However, their smaller scale might mean fewer resources than national companies, potentially resulting in longer wait times for claims processing or limited policy options.

They may also have less brand recognition and a smaller network of agents.

Independent Insurance Agents

Independent agents act as intermediaries, representing multiple insurance companies. This offers customers the advantage of comparing quotes from various providers without having to contact each company individually. Independent agents can provide personalized advice and tailor policies to specific needs, offering a higher level of customer service. However, their commission-based structure may influence their recommendations, and navigating multiple company policies can be complex.

Key Features to Consider When Choosing a Car Insurance Provider

Selecting the right car insurance provider requires careful consideration of several factors beyond just price. A comprehensive approach involves evaluating various aspects of the provider’s services and reputation.

- Financial Stability: Check the insurer’s financial ratings from agencies like A.M. Best to ensure their ability to pay claims.

- Customer Service: Consider reviews and ratings of the provider’s customer service responsiveness and helpfulness.

- Policy Coverage Options: Evaluate the range of coverage options available, ensuring they meet your specific needs.

- Pricing and Discounts: Compare premiums from different providers, taking advantage of available discounts.

- Claims Process: Research the provider’s claims process, looking for transparency and efficiency.

Reputable Car Insurance Companies Operating in Texas

Many reputable car insurance companies operate within Texas, offering a range of coverage options and price points. The following list represents a selection of well-established and widely recognized providers, but this is not an exhaustive list and should not be considered an endorsement.

- State Farm

- Geico

- Progressive

- USAA (membership required)

- Allstate

- Farmers Insurance

- Nationwide

Finding the best car insurance in Texas requires comparing multiple quotes and policies. Managing this efficiently can be challenging, but streamlining your workflow is key. Consider using a CRM like the neon crm demo to organize client information and track your progress. This allows for better organization of your insurance business which ultimately allows you to focus on finding the best car insurance rates for your Texas clients.